Power Projects Fuel Construction Industry Growth

Currently, overall construction spending is increasing globally after a prolonged slowdown. In the United States, Interface Consulting expects the increasing demand for energy and the retirement of older, less efficient power plants to drive investment in power projects. In recent years, the quantity and size of power construction projects has reflected considerable growth in that subsector. Based on Interface Consulting’s research and experience, this trend is expected to continue for several years. While there are several factors that contribute to this industry growth, some of the most significant factors include:

- A rebound in the residential and commercial sectors;

- Continued population growth;

- Slowing advancements in energy efficiencies; and

- Shifts in the selection of fuel sources for power generation.

Residential and Commercial Sector Rebound

In 2008, there was a significant decrease in residential and commercial construction; however, these sectors have begun to rebound in the past several years. The decrease coincided with the Great Recession, which was sparked by a number of factors including the US subprime mortgage crisis and financial crisis of 2007 and 2008. According to the National Bureau of Economic Research, the Great Recession ended in June 2009, and the residential and commercial sectors have seen drastic improvements since that time.

An increase in the construction of residential and commercial buildings is often coupled with increases in the construction of power facilities as the demand for electricity grows.

Continued Population Growth

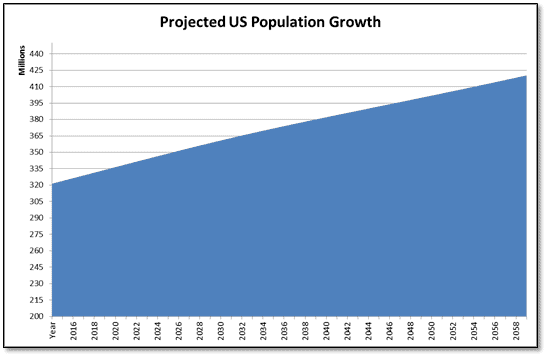

The US Census Bureau predicts that the US population will increase by almost 100 million people over the next 45 years, as shown in Figure 1 below. As the US population grows by 2.2 million people on average per year, the need for housing and commercial buildings grows as well. The facilities necessary to meet power demand will experience significant growth as existing facilities are expanded or reconfigured and construction begins on new projects.

Figure 1. Projected US Population Growth, 2015-2060

Source: http://www.census.gov/population/projections/data/national/2012/summarytables.html

Slowing Advancements in Energy Efficiencies

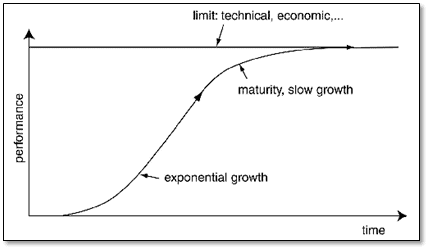

As shown in Figure 2 below, while energy efficiency improvements will continue, it is likely that those improvements will lessen as technologies mature. The power generation market will become comprised of more mature, highly sophisticated, and relatively cheap technologies capable of supporting many new and improved applications that have caused a decline in energy use per capita in recent years.

Figure 2. The Business S-Curve

Source: http://www.publications.parliament.uk/pa/ld200203/ldselect/ldsctech/13/1305.htm

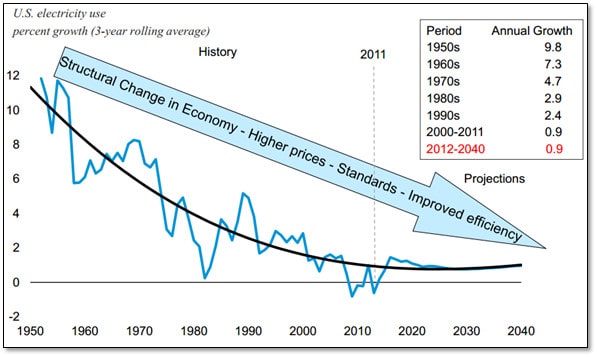

As technologies mature and near their performance limit, efficiency improvements will no longer be able to counter expected demand increases driven by the projected steady growth of the US population over the next 50 years. As shown in Figure 3 below, power demand will eventually attain a more constant growth rate that mimics the growth of the population.

Figure 3. Growth in Electricity Use Slows

Source: http://www.eia.gov/conference/2013/pdf/presentations/diefenderfer.pdf

Shifting Fuel Sources

Several shifts in the fuel sources used for electricity production will drive construction in the power sector.

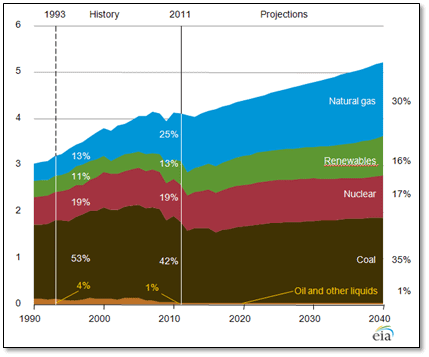

While coal is, and looks to remain, the top fuel used in the production of electricity, other fuel sources will slowly cut into the market share. This is largely due to the phase out of environmentally unfriendly power plants. Coal-fired generation is expected to reduce its market share because of continued concerns regarding the release of greenhouse gases.

Fuel sources likely to gain from the decline in coal use are natural gas and renewables. Nuclear power is expected to experience a slight decrease in the market share during a period of decommissioning of old plants and the construction of new plants. The following chart shows the projection of electricity generation by fuel as analyzed by the US Energy Information Administration.

Figure 4. Electricity Generation by Fuel, 1990-2040

Trillion kilowatt-hours per year

Source: http://www.eia.gov/forecasts/aeo/er/early_elecgen.cfm

As shown in the above graphic, almost all fuel sources aside from nuclear and coal are expected to increase in market share and will require even more generation facilities to meet the demand.

Natural Gas

In the U.S., the low cost and abundance of natural gas, due in large part to the shale gas revolution that is currently underway, makes it a desirable choice for energy production. Natural gas is an abundant resource with several applications, such as energy, heating, and auto fuels. Natural-gas-fired plants will likely replace the largest portion of coal’s lost market share, mainly because these plants are also much less expensive to construct, convert, and maintain than other plants.

Renewable Energy

Renewable energy sources such as wind, water, and solar power are sustainable and environmentally friendly. However, the high up-front construction costs, limited ideal production locations, and climate-dependent production of renewable energy projects have limited the growth of this energy subsector. But as the construction costs continue to decrease and technology becomes more efficient, renewable energy projects will become more attractive. Furthermore, big oil and gas corporations will look to diversify their market share by investing in renewable energy projects.

Nuclear Power

Nuclear power is expected to lose a small percentage of its current market share as several nuclear plants have recently begun the decommissioning processes. Among these plants are Duke Energy’s Crystal River plant in Florida, the San Onofre Nuclear Generating Station in California, and Dominion’s Kewaunee atomic reactor in Wisconsin.

Despite these nuclear plants going offline, nuclear power will retain a considerable portion of its current market share through the construction of new projects. Following a 30-year lull in nuclear reactor construction, it is expected that four to six new units may come online by 2020. The first of these comes from the 16 license applications made since mid-2007 to build 24 new nuclear reactors. Government policy changes since the late 1990s have helped pave the way for significant nuclear capacity increases. Additionally, the federal government and the nuclear industry are working closely together to expedite the approval process for new construction and plant designs.

Several major nuclear power construction projects have already begun in the US. The Alvin W. Vogtle Electric Generating Plant in Georgia, the Watts Bar Nuclear Generating Station in Tennessee, and the Virgil C. Summer Nuclear Generating Station in South Carolina are among the biggest new nuclear power projects currently under construction in the US.

One major advantage of increased nuclear power capacity includes low production costs because large quantities of energy are produced from a relatively small quantity of fuel. Additionally, nuclear power does not produce harmful gases and leaves little environmental waste under normal operating conditions. The main disadvantage in the use of nuclear power stems from the numerous concerns for the environment and worker safety in the event of overheating or a reactor meltdown, as well as finding a long term solution for disposal and storage of spent nuclear fuel. In addition, nuclear power plant construction is extremely complex, costs billions of dollars for individual projects, and takes 10 to 20 years before energy production is possible.

Interface Consulting Project Data

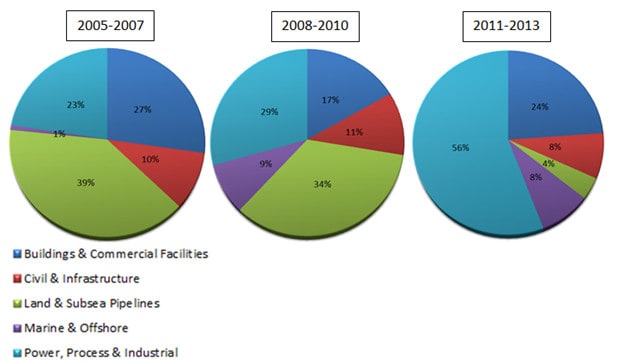

Interface Consulting tracks data on its consulting engagements and categorizes them according to industry sector. Power-related assignments are grouped within the “Power, Process, and Industrial” industry sector. Since 2005, Interface Consulting has seen a significant increase in the quantity of these assignments. When it comes to Power, Process, and Industrial projects; owners, contractors, and attorneys are retaining Interface Consulting as experts earlier in the project life cycle than in other industries due to the growing size and complexity of these projects. Interface Consulting’s scope of work on these engagements includes project management, claims management, and litigation or arbitration assistance. Many of these claims and disputes are often filed well in advance of project completion.

As shown in the following charts, the percentage of Interface Consulting Power, Process, and Industrial engagements has more than doubled over the past eight years.

Figure 5. Concentration of Interface Consulting Engagements by Industry Sector, 2005-2013

Source: Interface Consulting International, Inc., Project Data

Conclusion

Large and complex power projects will continue to see significant construction growth in the near future. The rebound in residential and commercial sectors, continued population growth, slowing advancements in energy efficiencies, and shifts in fuel sources for electricity generation will continue to drive power industry construction for years to come.

Source: Interface Consulting

View Full Article »